Jackson Hole Real Estate continues to show clear indications of a recovery in full swing. Third quarter closings shook off the doldrums of the Great Recession and posted numbers that we haven’t seen since 2006. These latest closing figures continue the trend for the year with each quarter posting higher numbers in both total sales and total dollars than the quarter before. Perhaps even more telling is the fact that these numbers are being driven by increases in all sectors of the market and all areas of Jackson Hole except 1. Single family homes, condos, vacant land and commercial properties all saw significant gains in July, August & September.

What’s the Exception? The only area of Jackson Hole that did not see an increase in closings this quarter was south of the town of Jackson. The decrease was slight. And it could be entirely accounted for by the relative lack of inventory under $1.5 million in Jackson Hole. That price category makes up the bulk of sales south of Jackson. In fact, overall inventory of Jackson Hole Real Estate under $1.5 million has dropped 15% since the previous quarter. It is also interesting to note that the average number of days that properties south of town have been on the market has also dropped. This would indicate that while there is less inventory currently, that which is available is being sold faster.

What’s the Exception? The only area of Jackson Hole that did not see an increase in closings this quarter was south of the town of Jackson. The decrease was slight. And it could be entirely accounted for by the relative lack of inventory under $1.5 million in Jackson Hole. That price category makes up the bulk of sales south of Jackson. In fact, overall inventory of Jackson Hole Real Estate under $1.5 million has dropped 15% since the previous quarter. It is also interesting to note that the average number of days that properties south of town have been on the market has also dropped. This would indicate that while there is less inventory currently, that which is available is being sold faster.

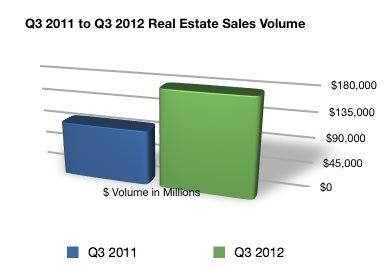

Let’s take a look at it by the numbers:

- 2012 Third Quarter compared to 2011 Third Quarter:

- Number of Units sold is up 33%.

- Dollar Volume of sales is up a dramatic 77.6%.

- 2012 Year To Date compared to 2011 Year to Date:

- Number of Units sold is up 17%.

- Dollar Volume of sales is up 31.5%.

The positive news for the market does not end there. Average monthly sales volume for July, August & September is up 93% as compared to the average monthly volume for the prior 6 months. In fact, September posted the highest single month of closings since November of 2007. Finally and perhaps most notably – average price of Jackson Hole real estate continued to increase throughout the quarter.

So what does this all mean? While it is impossible to predict the future, 3 strong quarters of growth in the Jackson Hole real estate market are certainly strong indicators of a recovery. Particularly interesting is the fact that this is happening across the board in all sectors and virtually all areas of the market. Finally, you can not ignore the fact that this is also happening while the average price of real estate is increasing. This would strongly indicate that the trend of sales being fueled by ever decreasing prices is also over.

Been thinking about purchasing real estate in the Jackson Hole market? Now could be an excellent time to do so. As we move into early winter, sales typically fall off which could make your offer more attractive to a seller looking at possibly having to hold their property until next summer. This also could mean they would be willing to accept a lower offer than they will consider next summer, particularly if 2013 continues this year’s strong growth. Interested in a specific area or type of property? Contact us today to get a customized market report highlighting properties of interest to you.